Every since the spectacular fall of the Markets in the credit crunch of 2009 there is a whole new generation of money lending companies who are replacing the banks as loan providers. This diverse range of private companies accept various types of collateral against the loans that they provide for hard up folk, anything from your car, your social security giro payment, and your wage receipts. It is safe to say that in working class areas these loan companies have replaced the banks in their capacity as money lenders, for evidence of this we simply have to walk down the high street of any run down town and city in the UK and we will see these lending shops in ever growing numbers.

Are pay day loans companies having a positive effect on people’s lives?

Are pay day loans companies having a positive effect on people’s lives?

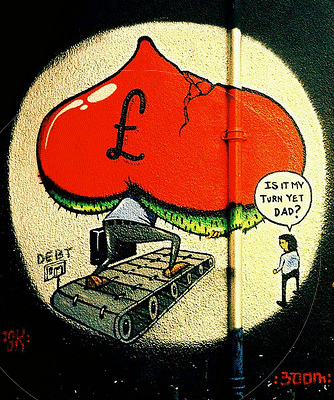

The banks are no longer lending money to people, and unemployment in the UK is increasing and as a result of this there are more and more people desperate to get their hands on much needed cash to feed their selves and their families and pay their bills. This area of desperation is where the pay day loan companies operate, and judging the by the ever increasing number of these money shops opening up all over the UK they are making considerable amounts of cash from peoples desperation, enough for them to expand their enterprises further in our towns and cities. I have friends and I’ve also spoken to other people who receive loans from these companies and they have basically all agreed that these companies have got you by the balls in the sense that they are able to supply much needed instant cash, on the other hand however, the hyper interest that is added to these loans means that borrowers are in the pockets of these companies for some considerable time as they struggle to pay off loans with interest rates varying roughly between 1400-4400%, so if you borrowed four hundred pounds for example, it would cost you £9 if you paid the £400 back the next day, and £185 if you paid it back over a forty day period.

People centred borrowing for a fairer future

In short, although these pay day loan companies are able to make cash instantly available, the longer term effect of the interest charged on these loans either plunges newer borrowers into poverty, and makes the lives of those already struggling to make end meet more miserable and desperate. These companies are nothing more than unwanted parasites in working people’s lives and they should be resisted on all fronts whenever possible. Pay day loan companies and all offshoots of this way of making money available to poor people really need to be shut down before they ensnare any other people in their inflated interest rate trap. The best and most sane way of borrowing money is from credit unions and community banks, or if you want to avoid the monetary system altogether and try something completely different, you could try signing up to Mark Boyles Freeconomy where you can trade your skills for things that you need, there are over 7 million people who have signed up to Freeconomy and this method trade and exchanging is growing by the day.

Steve