Permanent Culture Now is proud to offer the first of 3 guest posts from friend Alan on the origins of the Credit Crunch, Solutions and an Essential Reading List around all of these issues, we hope you enjoy this and please provide feedback on it as Alan would love to know what you think of his analysis.

The roots of the economic crisis are in the previous economic crisis, to understand these you have to understand how capitalism developed, works and its inherent contradictions.

Modern ’free’ market capitalism developed from feudalism, where serfdom or slavery developed into the concept of work where you would buy people by the hour.

Free markets and self regulation

This idea was developed by Adam Smith, who believed ‘Free Markets’ could be self regulating.

- Choice would be used to control prices and production.

- If the price of an item rises less people would buy it and buy an alternative item of equal utility that was at a lower price.

- For example if the price of turnips rose people would buy carrots if they were priced lower.

- The higher prices for turnips would attract more farmers to produce turnips until the overproduction of turnips causes increased price competition forcing prices down.

This essentially is Adam Smiths ‘Hidden Hand’ where self interest can regulate, supply demand and prices. This only occurs in a perfect market, and breaks down in the real world, examples are;

- In perfect markets, there is equality of information. For example a used car salesman knowing more about a car than the buyer is inequality of information. The same can be said about complex financial products, (Collateralized Debt Obligations’, Special Investment Vehicles’ and the sub-prime mortgages they are built upon). Companies can create inequality of information through criminal activities such as insider trading to maximize profits.

- The problem of externalities, where capitalists try to find ways of concentrating profits and externalizing loses. Making the taxpayer pay for the collapse of the banks, while keeping bonuses would be one example while manufacturing causing degradation of the natural environment, and getting taxpayers to pay for environmental cleanup would be another externality.

- In perfect markets there are no monopolies, montropolies or cartels to manipulate the markets. Adam Smith himself said no two traders meet without attempting to fix the market. This is why all free markets move towards monopoly, and need regulating.

- Institutional Capture, where the bodies tasked with regulating market abuses such as monopolies, insider trading, embezzlement and other forms of fraud and criminality end up being run by the firms they are supposed to be regulating through various forms of bribery, blackmail and intimidation. The revolving door between the financial sector, political representatives and financial regulatory bodies such as the Financial Standards Authority (in the UK) and the Security Exchange Committee (in the US) for example.

- In perfect markets demand is elastic and consumers have alternative goods for which they have no preference.

Demand is elastic if demand falls at the same rate as price increases. This is clearly not the case with essential goods (such as food, travel to work or fuel) or addictive goods such as fags. Demand is most elastic in goods that are most inessential where the consumer can simply stop buying said item until price drops, (such as cheap holidays in the sun)

It is ironic that the ‘Free Market” works most effectively to control prices in the most useless items, this is why capitalism is always environmentally destructive, and will always charge the poor more for food, heating and travel to work, (as the poor cannot defer eating until the price of food drops).

Modern speculative capitalism has developed out of all recognition from Adam Smith’s model, with for example professionalized management, whose interests differ from the owners (the shareholders), and complex financial products.

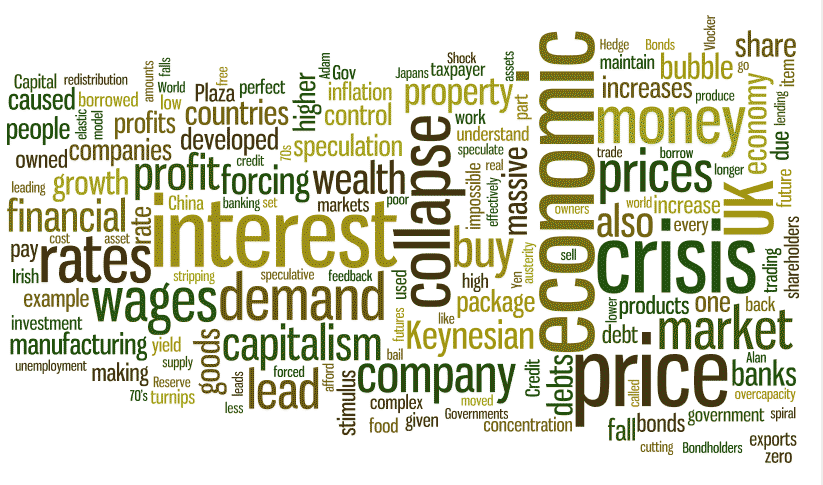

Essential terms to understand

They are the owners of businesses, they buy a part of a company called a share, and if more people want to buy than sell shares in a company the share price goes up. If a company makes good profits in any given year it pays out to its owners in the form of a share dividend, (a percentage of the share price).

Ltd liability law

This means that a Ltd Company’s owner’s personnel assets are not liable if the company fails

Bondholders

Bondholders lend money to a business for the guarantee of an interest payment, (called the bond yield). Bonds can also be bought and sold, where how economically secure a company is will effect the bond price, and its yield. Bondholders will only lend to companies in economic difficulties demanding high interest rates, and will buy bonds from other bondholders at a low price.

Bonds

Governments can also borrow by issuing Bonds, which pay interest (yield) and are freely tradable whose price varies according to supply and demand. If a company defaults on its interest payments it can foreclose on a company taking the shareholders assets, (rather like your mortgage).

Futures trading

They are generally where the buyer agrees to buy an item at a fixed price at a given point in the future. This was developed for farmers who could agree a future fixed price for there produce so by minimizing risk. Future’s trading now depends on high levels of borrowing and large degrees of market manipulation by speculators with no connection to the goods they are speculating on, usually undertaken by investment banks or Hedge Funds.

Hedge Funds

They are private firms who speculate on commodities, currencies, futures, debts and other sections of the less regulated over the counter trading of financial derivatives with large amounts of borrowed money.

Complex financial products

Debts and other complex financial products can be openly traded, where the sheer complexity makes them difficult to value.

Credit Ratings Agencies

These orgnisations rate the level of given debts risk supposedly making pricing of debts and other complex financial products possible.

Credit Default Swaps

This occurs where debts are insured and the cost of this insurance is determined by the Credit Ratings agencies. These are problematic as you can insure other people’s debts, drive down the price and get paid off. This is rather like insuring someone else’s house then setting it alight.

Private Equity

Where a privately owned company will try to take over one owned by shareholders with massive amounts of borrowed money, they will generally try to asset strip the company and set off its debts against Tax thereby paying little in the way of tax.

Insider trading

This is where a company/ individual abuses insider information to manipulate the market. This is supposedly illegal but widespread, and made much worse by the financial deregulation in the UK and US in the 80s.

Fractional Reserve Banking

This is the ability of banks to create fictional money. Banks can issue approx £10 lending for every £1 on deposit, creating £9 out of thin air. This can only be sustainable if 1/ all those with deposits do not withdraw them at the same time, (causing a bank run). 2/ There is perpetual ever increasing growth, (impossible as raw materials and people/demand is not infinite). Making a zero growth economy and environmental sustainability impossible within capitalism.

Quantitative Easing

This is where the government creates money to buy back Government bonds

Short selling

This is where a speculator enters into a futures contract to sell a share, bond or other financial product that they do not own at a given point in the future at a price hoping that the price drops (or forcing down price) so they can buy it on the open market at a lower price than in the futures contact pocketing the difference.

The origins of the credit crunch

The nub of the problem is the Marxist contradiction of capitalism which is the over concentration of wealth leading to the collapse of demand, prices, profits and the economy in a deflationary spiral.

This is exasperated by Fractional Reserve Banking where banks can create money out of thin air. Banks can issue 10X in lending what they have in deposits, with off balance sheet accounting this can increase to 100:1. For this to work economic growth has to constantly increase so the borrowers can pay their interest rates. Infinite growth is impossible, which is why zero growth and environmental sustainability is incompatible with capitalism. For companies to make profit, so they can pay the interest rates to there bondholders, and pay good yield to shareholders allowing the share price to go up they have to sell their goods to someone with money. If a limited number of companies have extracted so much from the consumer they can no longer afford the goods the companies produce the companies go bankrupt. Companies increases profits by forcing up prices, eliminating competition through market manipulation such as cartels and forcing down wages. But low wages mean a collapse in demand prices and profits, and the economic collapse of the company.

This is exasperated by Fractional Reserve Banking where banks can create money out of thin air. Banks can issue 10X in lending what they have in deposits, with off balance sheet accounting this can increase to 100:1. For this to work economic growth has to constantly increase so the borrowers can pay their interest rates. Infinite growth is impossible, which is why zero growth and environmental sustainability is incompatible with capitalism. For companies to make profit, so they can pay the interest rates to there bondholders, and pay good yield to shareholders allowing the share price to go up they have to sell their goods to someone with money. If a limited number of companies have extracted so much from the consumer they can no longer afford the goods the companies produce the companies go bankrupt. Companies increases profits by forcing up prices, eliminating competition through market manipulation such as cartels and forcing down wages. But low wages mean a collapse in demand prices and profits, and the economic collapse of the company.

Crisis leads to crisis

This is why every capitalist solution to the previous economic crisis sows the seeds for the next economic crisis. It is oddly the left forcing the redistribution of wealth that rescues capitalism from itself, the beast that eats itself.

It is the failure of the left from the late 70s onward to force the redistribution of wealth that has lead to capitalism stumbling from crisis to crisis.

In the wake of the collapse in the speculative bubble in shares in 1929, President Herbert Hoover tried to cut deficits which lead to the 1930’s Great Depression, by causing a deflationary spiral. Where over concentration of wealth lead to a collapse in demand, the collapse in demand lead to a collapse in prices, the fall in prices lead to a fall in profit, the fall in profit lead to employers cutting wages and letting staff go to maintain profit, the fall in wages lead to a further fall in demand and profits, and so on as a negative feedback loop. It is important to note that during deflation relative inflation can occur if wages fall faster than prices.

Keynesianism

John Maynard Keynes said Governments should borrow and spend to break this negative feedback loop, (counter cyclical investment). Governments could not cut there way out of a recession as cutting government spending would lead to further falls in wage’s, falls in taxes as unemployment rose and wages fell, and rising costs in unemployment benefit.. Cutting during a recession leads to higher government deficits due to the economic slowdown. FDR’s Keynesian stimulus package was partially successful from 1933 to 1937, where premature cutting back of government spending caused the US economy to dip again. The Keynesian stimulus was only partly successful due to two reasons, 1/ it was not bold enough 2/ Keynesian economics does not address the central contradiction of capitalism, which is the over concentration of wealth leading to the collapse in demand that can only be overcome with the re-distribution of wealth. Only with the Second World War was there a big enough stimulus package introduced, also full employment and rationing lead to a massive redistribution of wealth to finally lift the US out of the economic doldrums. In the aftermath of WWII, the massive destruction of manufacturing capacity in Europe leads to a long period of growth up to the 70’s.

John Maynard Keynes said Governments should borrow and spend to break this negative feedback loop, (counter cyclical investment). Governments could not cut there way out of a recession as cutting government spending would lead to further falls in wage’s, falls in taxes as unemployment rose and wages fell, and rising costs in unemployment benefit.. Cutting during a recession leads to higher government deficits due to the economic slowdown. FDR’s Keynesian stimulus package was partially successful from 1933 to 1937, where premature cutting back of government spending caused the US economy to dip again. The Keynesian stimulus was only partly successful due to two reasons, 1/ it was not bold enough 2/ Keynesian economics does not address the central contradiction of capitalism, which is the over concentration of wealth leading to the collapse in demand that can only be overcome with the re-distribution of wealth. Only with the Second World War was there a big enough stimulus package introduced, also full employment and rationing lead to a massive redistribution of wealth to finally lift the US out of the economic doldrums. In the aftermath of WWII, the massive destruction of manufacturing capacity in Europe leads to a long period of growth up to the 70’s.

World War 2 and beyond

Militancy in the aftermath of WWII, also prevented the over concentration of wealth.

It was this Keynesian boom that continued from the end of the 2nd World War until the 70s economics crisis. It is in the roots of the 1970’s economic crisis one has to look to understand the present one. Because it was in the capitalist solution to inflation/overcapacity that sowed the seeds of every crisis from the 1990’s economic crisis up to present. This Keynesian economic model fell apart in the 70’s. The crisis of profit was rooted in structural overcapacity (for example too many car makers chasing too few consumers). This meant that any Keynesian counter cyclical economic stimulus (where governments would borrow and spend) caused inflation/speculation. Where the well off sought to roll back the more equitable post war settlement with differential wage inflation/wage controls. Oil prices increases were exacerbated by speculation, the OPEC oil producer’s cartel controlling supply volumes and political instability in the Middle East.

It was this Keynesian boom that continued from the end of the 2nd World War until the 70s economics crisis. It is in the roots of the 1970’s economic crisis one has to look to understand the present one. Because it was in the capitalist solution to inflation/overcapacity that sowed the seeds of every crisis from the 1990’s economic crisis up to present. This Keynesian economic model fell apart in the 70’s. The crisis of profit was rooted in structural overcapacity (for example too many car makers chasing too few consumers). This meant that any Keynesian counter cyclical economic stimulus (where governments would borrow and spend) caused inflation/speculation. Where the well off sought to roll back the more equitable post war settlement with differential wage inflation/wage controls. Oil prices increases were exacerbated by speculation, the OPEC oil producer’s cartel controlling supply volumes and political instability in the Middle East.

Economic growth with this overcapacity became a zero sum game internationally, (and nationally), where one countries development could only be at another’s expense. Companies could only maintain profit by forcing down wages and asset stripping, not by growing. Capital investment moved from manufacturing due to low profit, (in the west) to speculation for higher returns.

Friedman gets in on the game

Various economic ideologues were used by the plutocracy; to regain the world that by rights belonged to them, Hayek and Milton Friedman for example. Milton Friedman (the monetarist Chicago School poison Dwarf) stated in the 70s that it was impossible to have full employment without inflation in the UK as Unions kept wages artificially high.

Various economic ideologues were used by the plutocracy; to regain the world that by rights belonged to them, Hayek and Milton Friedman for example. Milton Friedman (the monetarist Chicago School poison Dwarf) stated in the 70s that it was impossible to have full employment without inflation in the UK as Unions kept wages artificially high.

Although the rich paying themselves whatever they liked was apparently not inflationary at all. The free market was efficient (the efficient market hypothesis) unlike the state so every thing was to be privatized & unions were to be smashed to control this supposed wage/inflation spiral. In the UK and US structural unemployment, de-industrialization & outsourcing were used to control wages/Inflation with interest rates set to control the money supply/Inflation. In the UK this was an economic failure only masked by North Sea oil and the flogging off of UK assets. That people had stagnant/falling wages meant the possibility of a collapse in demand and with it the economy. This was overcome in the short term with speculation (borrowing from the future) and a massive increase in lending to those they had recently impoverished so they could keep consuming and companies could maintain there rate of profit. Obviously this can only continue until these impoverished can no longer make the interest payments.

Crisis 1970’s onwards

Economic crisis occurred with increased frequency from the 70’s onward.

1/ The 1973-75’s economic crisis, where the huge cost of US involvement in Vietnam plus the cost of Lyndon Johnson’s ‘Great society’ (designed to quell unrest at home ) lead to the US coming off the Gold Standard (where the $ has a set exchange rate against Gold) exacerbating problems of overcapacity leading to inflation.

1/ The 1973-75’s economic crisis, where the huge cost of US involvement in Vietnam plus the cost of Lyndon Johnson’s ‘Great society’ (designed to quell unrest at home ) lead to the US coming off the Gold Standard (where the $ has a set exchange rate against Gold) exacerbating problems of overcapacity leading to inflation.

2/ 1979 Vlocker Shock, where the US jacked up interest rates, to control inflation.

3/ 1982-90 Developing countries debt crisis, in part caused by the massive increase in interest rates on their foreign debt (caused in part by the Vlocker Shock).

4/ 1984-92 US savings and loans crisis (a bank run) and speculative boom and bust in the UK property and share market, both caused by deregulation in the UK and US.

5/ 1985 Plaza accord, where the US forced Japan to revalue the Yen upwards with the threat of trade sanctions, making Japanese exports less competitive, and made US exports more competitive. Japans exports collapsed, and Japanese capital moved from low profit manufacturing to speculation such as on property.

5/ 1985 Plaza accord, where the US forced Japan to revalue the Yen upwards with the threat of trade sanctions, making Japanese exports less competitive, and made US exports more competitive. Japans exports collapsed, and Japanese capital moved from low profit manufacturing to speculation such as on property.

6/ 1990-92 Nordic countries property bubble and bust and Japanese banking crisis

7/ 1994-95 Mexico peso/debt crisis

8/ 1995 Reverse Plaza accord, where the US allowed the Yen to be revalued downwards.

9/ 1997-98 Asian currency/property crisis.

10/ 1998 Long Term Capital Management US Gov bail out, (a Hedge Fund making massive hedging bets on currency fluctuations with massive amounts of borrowed money).

11/ 1998-2001 Capital flight/ Asset stripping of Russia due to neo liberal ‘Shock Therapy’, followed by Russia’s bankruptcy. Then Brazil,

12/ 2000-2002 Argentinean debt crises, peso crisis

13/ 2001-02 Dot Com bubble and collapse followed by the collapse in Enron and World Com

Under ‘Reganomics’, after the Vlocker shock increase in interest rates and subsequent rise in the value in the $ in part caused US de-industrialization and other forms of asset stripping. The US moved to a resurgent manufacturing export industry after the Plaza Accord devalued the $ (and forced the Yen upwards), and repressed wages to enhance corporate profits.

Under ‘Reganomics’, after the Vlocker shock increase in interest rates and subsequent rise in the value in the $ in part caused US de-industrialization and other forms of asset stripping. The US moved to a resurgent manufacturing export industry after the Plaza Accord devalued the $ (and forced the Yen upwards), and repressed wages to enhance corporate profits.

From 1995 the reverse Plaza Accord (in an attempt to rescue the Japans economy destroyed by the Plaza accord) forced the $ with higher interest rates, making US exports uncompetitive. US Capital shifts from manufacturing to speculation due to the falling rate of profit. The high US interest rate attracts foreign investment, especially from Japan as its interest rates are near zero after Japans economic collapse in 1997, (called the carry trade). This excess liquidity leads also to a bubble in the US stock market, and a boom in consumption.

The US stock market E bubble collapsed in 2001.

Alan Greenspan (Chairman of the US Federal Reserve at the time) massively dropped interest rates in the wake of the bursting of the Dot com bubble, to avert economic collapse. The drop in US interest rates feeds a property bubble, and credit keeps consumption going while wages are falling in real terms. The effects of wage repression are also masked by cheap imports increasingly from China. This causes a problem if you are going to offshore manufacturing to drive down wages, and replace wages with credit to maintain demand peoples debt increases until they cannot afford the interest rates never mind the principle debt.

Different approaches to the same problem

Different countries have tried slightly different approaches to deal with this economic crisis, none of which could even vaguely be described as Keynesian (despite its limitations). Practically all the countries affected slashed interest rates, effectively allowing free money to the banks to speculate against the public in the form of forcing food and fuel higher and currency speculation. Quantitative easing, this is effectively printing money to buy back Government bonds giving yet more money to speculators who hold Gov bonds to speculate against the public. Zero interest rates and QE have also lead to a reverse carry trade where money is borrowed from the west to invest in the countries with a higher return such as China, pumping demand in China and forcing up inflation. China is also one of the few countries to heavily invest in infrastructure.

Different countries have tried slightly different approaches to deal with this economic crisis, none of which could even vaguely be described as Keynesian (despite its limitations). Practically all the countries affected slashed interest rates, effectively allowing free money to the banks to speculate against the public in the form of forcing food and fuel higher and currency speculation. Quantitative easing, this is effectively printing money to buy back Government bonds giving yet more money to speculators who hold Gov bonds to speculate against the public. Zero interest rates and QE have also lead to a reverse carry trade where money is borrowed from the west to invest in the countries with a higher return such as China, pumping demand in China and forcing up inflation. China is also one of the few countries to heavily invest in infrastructure.

The banking bailouts means that the taxpayer is underwriting the banks speculating on property and other financial derivatives. The UK Gov owned RBS and Lloyds are liable for its exposure to the collapse in the Irish and Spanish property bubbles. The UK banking sector is exposed to the Irish property sector to the tune of £1.5Tn, larger than the UK economy the exposure of the UK taxpayer is through RBS (84% owned by the taxpayer) and Lloyds (also 42% owned by the UK taxpayer, exposed by £4.3 Bn to the Irish property market) and Northern Rock. An austerity package (such as in Ireland) increases the numbers defaulting on there mortgages, and as Ireland (like the UK) have underwritten the banks, the austerity package increases the banks bad debts until the country underwriting them can no longer afford to bail them out. This is why Ireland’s austerity package has reduced Irish Gov bonds to one grade above ‘junk’ status. The UK is following this misconceived economic model.

As there has been no re-balancing of the world economy or re-distribution of wealth this approach will fail, finding rich people and stuffing money down their throats while making the poor pay for it is not a Keynesian stimulus package.

This is the real reason for the present economic collapse.

Part 2 the solutions, coming soon

Sign up to the Permanent Culture Now newsletter to be kept informed new articles, films and new exclusive content.