Our first guest post from Money Bags on the debt based economy that we live in.

“It is actually not in the least surprising that nations are chronically in debt, governments have inadequate public resources, public services are underfunded and people are beset by mortgages and overdrafts. The reason for all this monetary scarcity and insolvency is that the financial system used by all national economies worldwide is actually founded on debt. To be direct and precise, modern money is created in parallel with debt.” Michael Rowbotham, The Grip of Death (1988)

“Money doesn’t mind if we say it’s evil, it goes from strength to strength. It’s a fiction, an addiction, and a tacit conspiracy.” Martin Amis, Money (1984)

This article is the first in a series of short papers which will explore what has been termed the ‘debt-based’ economy. As preposterous as this may initially sound, it will be argued that because of the way in which banks create money from nothing and then supply it to the economy as a debt rather than lending money already in circulation, it is logically impossible for us to ever pay off our national debts without reform of the monetary system. Indeed, we will show that because of compound interest and the way in which money flows within our economy,an ever-increasing level of debt is required for our economies to function, hence the term debt-based economy.

Debunking the myths

Therefore, in order to debunk the most widely held misconceptions people have concerning money, we will pay particular attention to how money is created and moreover, who creates it. In contrast to mainstream economic orthodoxy and whatever our political class and mainstream economists may tell us, it will be shown that it is private banks that are the real masters by their ability to either flood the economy with cheap credit causing wildly inflated asset prices (and by extension booms), or by contracting the money supply sharply and causing depressions.

In addition, once we have explored and examined our current system of money creation, it will become apparent that statements such as “There’s not enough money” or “We need to pay off our debts” are simply rhetorical statements for political spending initiatives (or lack or spending, as the current austerity measures illustrate). More importantly, it will be demonstrated that once the public has accepted these claims concerning the need to curb government spending, austerity measures will actually harm the economy rather than stimulate it (as is evidenced by the UK economy recently sliding into a double-dip recession).

The present situation

Before discussing the real issue of money creation, it may prove helpful to sketch a brief overview of where we are currently are in terms of our national finances in order to substantiate our claim regarding the centrality of debt in the modern economy.

In March of this year, The Office for National Statistics published its Public Sector Finances March 2012 report. Below is a snapshot of our national finances for the month of March:

- a current budget deficit excluding the temporary effects of financial interventions of £11.1 billion

- net borrowing excluding the temporary effects of financial interventions of £18.2 billion

- net debt excluding the temporary effects of financial interventions was £1022.5 billion, equivalent to 66.0 per cent of GDP

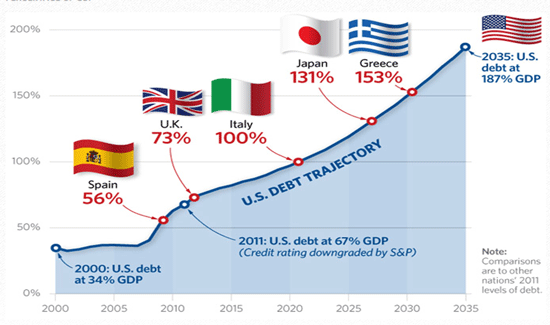

In the light of our evident prosperity, technological innovation, greater productivity and such like one must surely wonder why, as a nation, we are so indebted and need to persistently borrow more money? Is it just mismanagement of our economy by our government? Are our European neighbours managing their economies with equal ineptitude? A quick look at the global picture sheds a similarly depressing picture.

At the time of writing the following European countries are officially in recession: UK, Greece, Spain, Italy, Portugal, Ireland, Belgium, Denmark, Holland, Czech Republic and Slovenia. Let’s take a quick look at their debts as a percentage of their Gross Domestic Product.

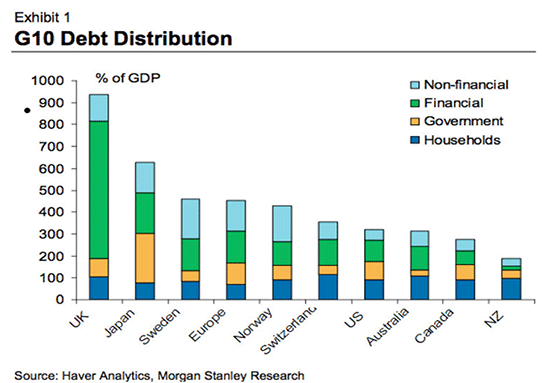

If we factor in private debt, i.e. debt that includes loans, mortgages overdrafts and such other household debt then the figures become so large as to become almost nonsensical:

In the light of these astronomical numbers, one has to ask how it is that all these national economies are drowning in such vast amounts of debt? The guiding thread that ties all these figures together is the process of how money is created and by whom and it is to a discussion of this that we shall now turn.

The Money Creation Process

“Most people imagine that if they borrow from a bank, they are borrowing other people’s money. In fact, when banks and building societies make any loan, they create new money. Money loaned by a bank is not a loan of pre-existent money; money loaned by a bank is additional money created.” Michael Rowbotham, Grip of Death (1998)

“Where did the money come from? It came – and this is the most important single thing to know about modern banking – it came out of thin air. Commercial banks – that is, fractional reserve banks – create money out of thin air.” Murray Rothbard, The Mystery of Banking (2008)

“… by far the largest role in creating money is played by the banking sector… When banks make loans they create additional deposits for those that have borrowed the money.” Paul Tucker, Deputy Governor of the Bank of England (BoE Quarterly Bulletin 2007)

Most people – politicians and economists included – do not understand money mechanics and our modern system of money creation because such discourse has been suppressed from the public arena. Indeed, such issues, even though they affect all sections of society (usually disproportionately), are typically unregistered interests of most members of society. It will be argued here that only by understanding our current system of fiat currency creation and its reform will we be able to take positive steps in moving our economy in a more sustainable direction.

The saver-borrower paradigm

“Put simply – and at its most fundamentally – banks do not lend out its customers’ deposits: banks create money from nothing.”

The majority of the population subscribe to what I shall call here the ‘saver-borrower paradigm’. What I mean by this is that it is often assumed (albeit wrongly) that banks lend out other people’s deposits and charge interest, thereby making a profit. Put simply – and at its most fundamentally – banks do not lend out its customers’ deposits: banks create money from nothing.

The majority of the population subscribe to what I shall call here the ‘saver-borrower paradigm’. What I mean by this is that it is often assumed (albeit wrongly) that banks lend out other people’s deposits and charge interest, thereby making a profit. Put simply – and at its most fundamentally – banks do not lend out its customers’ deposits: banks create money from nothing.

Whenever we walk into a bank and ask for a loan, mortgage or overdraft, commonsense tells us that the bank ‘loans’ us money from its pre-existing deposits, that is other people’s savings. This is by far the biggest misconception held by most people regarding how banks function. What actually happens is that the bank creates what is called a ‘demand deposit’ and credits the amount requested against it.

The logical consequences of this are three-fold:

- The vast majority of all money created is ‘number money’ created by private banks by simply tapping numbers into a computer

- All money that is issued by private banks therefore takes the form of debt (because it is borrowed into existence)

- Because of the above, all money is debt. In other words, all money currently in existence is money that is owed.

With regard to the first point, in 2010 there was £53.5 billion circulating in the UK economy in notes and coins. However, the money supply that has been privately created (what economists call the ‘M4’ aggregate) which is the sum total of the aforementioned bank-created demand deposits stood at £2.15 trillion. This means that 97.4% (£2.1 trillion) of all monies created in the UK was created by private banks by issuing money out of thin air.

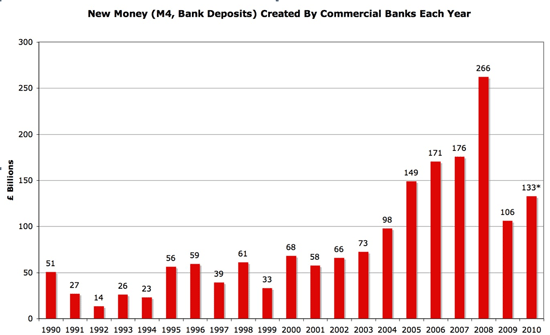

In addition, because all loans which are created are new money i.e. additional money, we have an ever-increasing money supply which gives rise to a number of issues (most notably inflation) which will be discussed at a later stage. Below is a chart outlining the growth of the privately created M4 money supply between 1990 and 2010 (note how 2008 was the year of several bank collapses):

With regard to all money being created and issued as a debt and the consequences that this entails, then a hypothetical example should help illustrate.

Let us imagine that Mr Smith walks into Bank PLC and asks for a £100,000 mortgage which the bank agrees to. As discussed, the money supply has now increased by £100,000 (this £100,000 being what is called the ‘principle’). However, Bank PLC has charged 10% interest which means the total repayable will be £110,000. And therein lies the problem: the money needed for the interest payments is not in the money supply.

Debt can never be paid off

In order for the interest payments to be paid someone else will have to go into debt in order to increase the money supply by the necessary amount. The logical upshot of this system is that it is impossible for all the money in existence to be paid off because only the principle and never the interest is created. Indeed, as long as interest is charged whenever money is borrowed into existence and money continues to be re-loaned once created, then this process of people needing to continually go into debt to increase the money supply has to continue ad infinitum.

In order for the interest payments to be paid someone else will have to go into debt in order to increase the money supply by the necessary amount. The logical upshot of this system is that it is impossible for all the money in existence to be paid off because only the principle and never the interest is created. Indeed, as long as interest is charged whenever money is borrowed into existence and money continues to be re-loaned once created, then this process of people needing to continually go into debt to increase the money supply has to continue ad infinitum.

Furthermore, due to there always being a persistent shortage of money in the money supply (because the interest is never created alongside the principle and the way in which money flows among people), we are consequently in constant competition with one another as the money in existence is never enough to cover all debt plus interest. This means therefore that competition and bankruptcy and inherent aspects of our monetary system.

Moreover, those that are unfortunate to become bankrupt will lose their assets which are in turn repossessed by the banks which issued the ‘money’ to buy those assets from thin air! Indeed, it should now be apparent that one fundamental consequence of living under a debt-based economy is the invariable law of assets slowly being transferred from us to the banking system through bankruptcies and foreclosures.

Paying off the debt could be catastrophic

With respect that the above implications have with respect to our national debt, it should now be obvious that any attempt to pay off our national debt will ultimately be deleterious, as paying of debt is tantamount to extinguishing it from circulation which will collapse the supply of money available. This is how depressions arise due to there being a shrinkage of the money supply due to banks failing to lend.

With respect that the above implications have with respect to our national debt, it should now be obvious that any attempt to pay off our national debt will ultimately be deleterious, as paying of debt is tantamount to extinguishing it from circulation which will collapse the supply of money available. This is how depressions arise due to there being a shrinkage of the money supply due to banks failing to lend.

As is evident, there is only one winner in our debt-based economy and that is the banking system that is allowed to create money at will and out of thin air at no costs to themselves.

Needless to say that the above analysis has been a short overview of the main tenets of the banking system. Over the following weeks we will explore these and other issues in greater detail and examine some of the other pernicious effects of a debt-based money supply such as inflation, the role of banks in creating booms and depressions, fractional-reserve banking and outline some tentative solutions.

By way of conclusion, however, it may prove helpful to heed the words of Lord Stamp (1937):

‘If you want to be slaves of the bankers, and pay the costs of your own slavery, then let the banks create money.’

So say today we struck all debt from existence , that would also in turn, erase most of the “money” in existence. It would cause chaos , is that the way to go with it? Who would even have the power to change this system that’s so pervasive.

great article, but what i want to know is what we can do about it? i agree if everyone makes small changes it can have an impact. for a start i no longer have any loans or credit cards and my one current account is in credit. however, what do we do about mortgages? is there another way to live without one? they are probably the biggest interest income for the banks due to the size of the debt. i welcome your ideas on what we can do?

We should just stop taking part in this system. It is not sustainable very long anyway.

Here is the solution:

http://www.thevenucproject.com

Jacque Fresco has been working on this sustainable solution since the great depression.